1099 Compliance Basics for Businesses, Corporations & Independent contractors/consultants

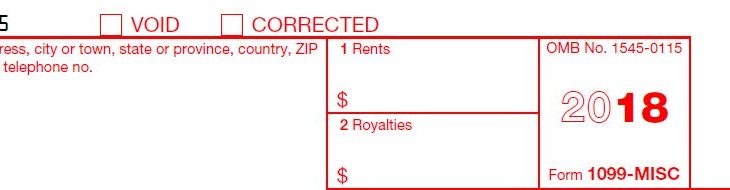

For Businesses & Corporations As a business owner, you may be hiring independent contractors for your business. If you have paid any amount greater than $600 during the calendar year, you may be required to file a FORM 1099-MISC with IRS. A copy is sent to the contractor and a copy is sent to theRead more about 1099 Compliance Basics for Businesses, Corporations & Independent contractors/consultants[…]